Wages Vs. Medical Cost

One of the biggest squeezes on our paycheck is the impact of rising healthcare cost. Wage stagnation and rising cost of health insurance have plagued the working class of the US for decades. On average, in the US in the 1980s the percentage of take home that was eaten by healthcare costs was no more than 9% a year, in the early 2000s it was around 15%. Today, the American working class may have to devote 25% or more to health-care.

Just as the entire country, this problem plagues us at Lynn. Our contract campaign heavily focused on this fact and was a main focus during contract negotiations.

The 6%, 6%, 6% and 0% increases to medical premiums in the TA as well as the one time Deductible Increase can equal between 19% and 45% (depending on your plan and number of people covered) increase to health care costs in the lifetime of the contract. These figures look terrible and can be misconstrued and misinterpreted, especially when compared to the 16% increase to wages.

When the bargaining committee looked at the numbers, we always took into account, the complete worst case scenario. Someone on first shift, who does no overtime and is on the most expensive plan, with a full family, who is has high medical usage and is forced to pay the entirety of their Out of Pocket Max. In that situation, around 15% of that person's annual gross income (before taxes or all other deductions) would have to be dedicated to medical costs.

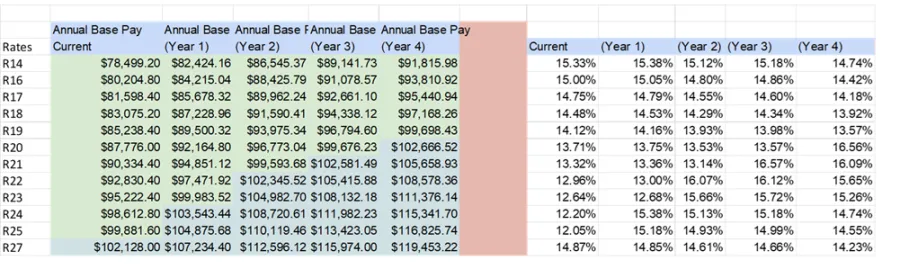

The above picture illustrates this situation for all classification in Lynn throughout the entirety of the contract.

Overall there is a downward trend to the amount of money you could possibly be on the hook for to cover medical costs. This is achieved because the 5%, 5%, 3%, and 3% ultimately outpace the increases in healthcare costs in the lifetime of the contract. This is before considering the impact of an unfrozen Cost of Living (COLA) formula that will continue to soften the blow of inflation.

The hardest blows in the duration of the contract will be for those classifications whose wage increase would take them over the edge and into a higher medical bracket bringing the percentage of their yearly earnings eaten by healthcare back up. This was a major sticking point for the bargaining committee which sought to find the best possible scenario across all sites. However delaying wage increases to prevent a group from going over the edge in any scenario was never to our advantage and the practical "more money earlier" always netted a greater gain across members nationally. After the initial blow of going over to the next health care bracket was overcome, wages once again outpaced the increase to health care costs.

Comparing "6%, 6%, 6% and 0%" and "5%, 5%, 3%, and 3%" on two different topics oversimplifies the issue and should not be confused with the overall and net gain from the entire package. Plain and simple, these numbers achieve one of the Bargaining Committee's key functions, more money in your pocket, earlier, and for everyone.

“An Injury to One is an Injury to All” An Interview with a CWA Union Leader in Minnesota on Defending Members from ICE Operations in MN 2-3-2026

2025 Update to MBW Agreement Ratified per Membership Vote 1/27/2026